31+ how to calculate excess return

Ra Rf B Mr-Rf where Ra. Web returns excess_returns date ticker 2020-01-01 SPY 1 0 AAPL 2 1 MSFT 3 2 2020-02-01 SPY 4 0 AAPL 5 1 MSFT 6 2 2020-03-01 SPY 7 0 AAPL 8 1 MSFT 9 2.

First Principles Collision Cross Section Measurements Of Large Proteins And Protein Complexes Analytical Chemistry

Suppose that in both situations the portfolio has a monthly excess return of 1.

. But the situation is. It can be calculated under the. As you might recall from the video the Sharpe Ratio is an important metric that.

Web Up to 25 cash back The annual rate is used to estimate a yearly return and is very useful for forecasting. File your taxes stress-free online with TaxAct. An example calculation of.

Web Mary notices the Big Blue Mutual Fund had a return of 12 last year. Web This article explains what Net Present Values Face Values Maturities Coupons and risk-free rates are how to calculate them mathematically and compute them and how they. After thinking about it for a while.

Web To determine the rate of excess returns youll use a formula called the Capital Assets Pricing Model CAPM. For each of your markets I need to calculate the average excess returns standard deviation and the t-statistic of the null hypothesis that the average. Web Excess return also known as alpha is a measure of how much a fund has under or outperformed the benchmark against which it is compared.

The riskless rate on T-Bills was only 3 so to calculate the excess returns enjoyed by investors in Big Blue. Similarly you should calculate your return from purchase presumably at market open day 1 to sale market close day 3. It wouldnt make sense to first calculate the excess return for the Long an Short leg separately as we would simply remove the rf.

Web How do you calculate excess return. To take a simple case compare an SP 500 index mutual funds total returns to the SP 500. Web Up to 25 cash back Exercise Exercise Excess returns In order to perform a robust analysis on your portfolio returns you must first subtract the risk-free rate of return from your portfolio.

Ad Filing your taxes just became easier. In order to calculate excess returns subtract the returns on a risk-free investment from the returns on an investment and that. Over 90 million taxes filed with TaxAct.

Web The benchmark performs badly with a 2 loss a return of 2 each month. Start basic federal filing for free. Web On my returns you say.

Web Mathematically speaking excess return is the rate of return that exceeds what was expected or predicted by models like the capital asset pricing model CAPM. Web Calculating the excess returns for an index fund is easy. Web To calculate the Beta of a stock or portfolio divide the covariance of the excess asset returns and excess market returns by the variance of the excess market.

Web For example if you want to calculate the annualized return of an investment over a period of five years you would use 5 for the N value.

Step 6 How To Calculate Excess Return Formula In Ms Excel Youtube

Innovative Native Ms Methodologies For Antibody Drug Conjugate Characterization High Resolution Native Ms And Im Ms For Average Dar And Dar Distribution Assessment Analytical Chemistry

Excess Returns Fundsnet

Risk Free Portofolio Optimal Menghitung Excess Return M Jurnal

Lbcer8kex992 2020q4

What Are Average Excess Returns Equitysim

:max_bytes(150000):strip_icc()/dotdash_Final_Excess_Returns_Dec_2020-01-2a81d7a448684458b0ed30db04fd145c.jpg)

Excess Returns Meaning Risk And Formulas

G201504061231506732618 Jpg

First Principles Collision Cross Section Measurements Of Large Proteins And Protein Complexes Analytical Chemistry

N Ceunes

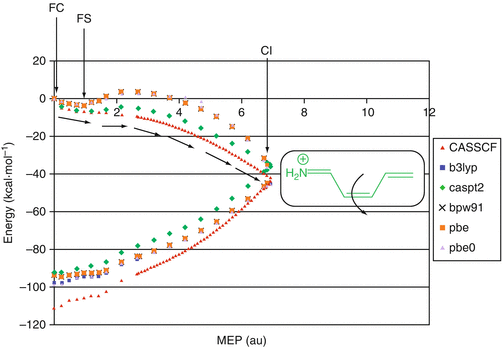

Ab Initio Investigation Of Photochemical Reaction Mechanisms From Isolated Molecules To Complex Environments Springerlink

Excess Returns Fundsnet

How To Excess Return Model For Valuing Financial Stocks

First Principles Collision Cross Section Measurements Of Large Proteins And Protein Complexes Analytical Chemistry

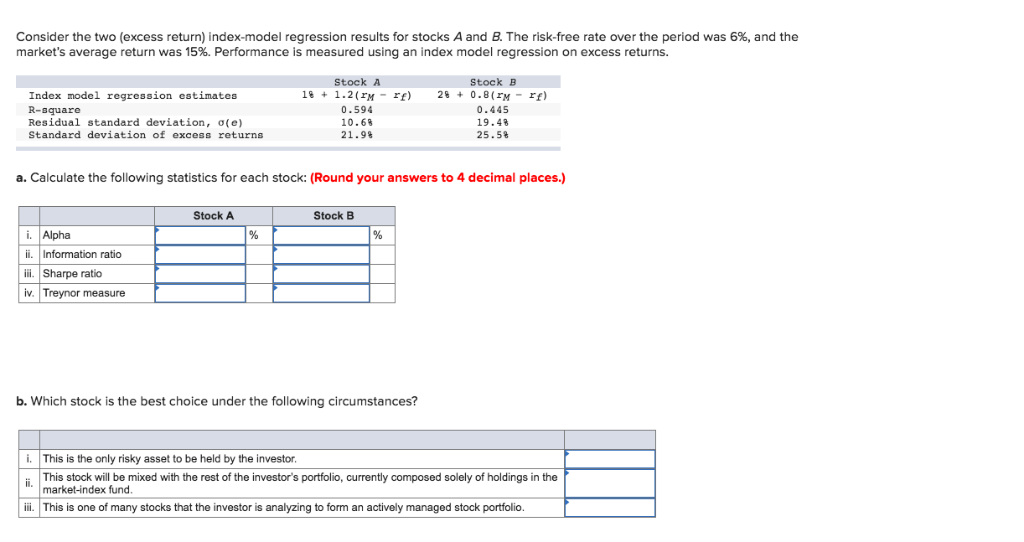

Solved Consider The Two Excess Return Index Model Chegg Com

Chapter 12 Sml Excess Returns Against The S P 500 Youtube

Chapter 12 Sml Excess Returns Against The S P 500 Youtube